This is a loose draft released for expediency, I will be back to improve it but want the open support of the community to help analyze these points for greater awareness to exceptional teamwork, how to move growth capital to the economy expediently and other relevant points on analysis. The GOAL is to improve on Teamwork and to be fair in stating the perceived / anticipated shortfalls on the implementation of this segment of the Jobs Act.

Released In Beta from a Linkedin Post to Villanova's John Scarpa Center for Law and Entrepreneurs.... connects some issues observed from the SEC FINTechi Innovation forum and an impirical question of why did it take so long (a thesis under review to dispute or affirm the length of process which seemed intiutively very long relative to more urgent need on growth capital... who was being protected on delay (big business, banks or investors?) .... was the Risk managed in a cost- benefit manner? = a beta on a Rule Making process and efficiency test to follow)

While Rome Burned and the need was Growth Capital..... Did we get lost on Studying Micro Cap Risk ? (a thesis on cost-benefit / case study in review)

Background some rough facts in layout (precision on times and events can follow later generalities are enough here to make the case then test it):

Banks nearly Collapse and Presidents Bush ? (long time ago).... and Obama and Congress have the bail out lines and define.....

The American Jobs and Opportunities Act ( under review but recalled as the source of the Crowd Funding start lines.... open to confirm but believed from memory as source)

American Poverty = 14% appx. (actual 13.65% ??) that's 43 American Men, Women and Children in need of Opportunities on #EGALBO this is as of 2016 after almost 8 years of the administration at 11/15/16 (need to review trend on same).

American Homelessness which includes American Veterans and others who have fallen off the Economic Ladder due to lack of opportunities and other factor needs like MH support. Regardless still Americans in need of support where there but for the grace could go many... ARE UNCOUNTED BY US CENSUS though the states may have these States.... this is an American Disgrace especially 8 years into the administration (need to revisit what actions were taken).

51 % of Americans Earn less than $30,000.00 per year per US Census sources (foot this).

Small Business = Engine of Job Growth and Creation as per SBA and Our Government

Despite the many feel good reports of Jobs and Even I would tell you I am now sensing better headwinds.... we have 63% Participation Only in the workforce and in that number of 37% non participation which is 3% worse than under prior administration to Pres. Obama as a segment which is an estimated 176 Million of 321 Million or so Americans Eligible so on average

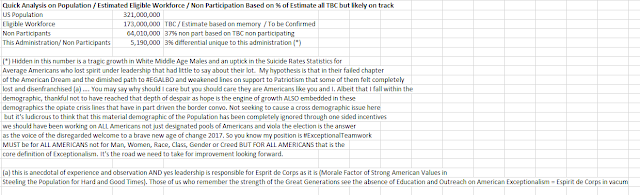

This Graphic may upset you but it's too important not to include:

vacuum as intended in exhibit.

A hypothesis in development from a casual observation on the SEC lines of FINTECH..... Could the SEC have moved more timely on Crowd Funding? .... was growth a firm center to initiatives, Who was defined as the party at Risk to be covered on Crowd Funding and how were they protected beyond forms, filings et al. SEC has long had IPA / Investor Protection Awareness outreach perhaps some measure of simplified financials and reporting add IPA would have just as well sufficed and speeded much needed growth capital to the economy not otherwise available at SBA on lines which were also picking winners and losers and excluding entire classes of equal needs.

The Case is made from above of Critical needs in the Economy for Growth Capital in a backdrop of urgent Economic Challenges over the last 8 years. The feeling of a casual nature to process seemed to imply the rules were over studied so we have a first class test case here in the efficiency of rule making and the question of while Rome burned, who took affirmative action to free up growth capital?? ..... aka is it just an intuition or a fact that Crowd Funding Rules for Micro Cap segment took a long long path to clearance as other channels ran dry eliminating significant pathways to economic growth for entrepreneurs and small business. The embedded case study question to test and prove is did we run overkill on regulation of crowd funding and hurt the economy?, how did we manage Risk here and were the interests of Investors, Big Banks or other players served here when the need for mom and pop was growth capital for small business that seemed to never make it to main street. It's the type of question that needs to be asked for Lessons Learned on the Crowd Funding / Small Cap pathways to growth.

I was in the midst of listening to edits from the SEC FINTech Forum and came to the observation of age and impatience that we have been collectively seemingly waiting a long time for crowd funding rules where any rational observation would have been to expedite capital access pathways not available under SBA loans which also were more focused on SMWBE AND even SMWBE expressed difficulties to access on SMWBE loans so they also would have benefited from faster action on Jobs and Opportunities Act Crowd Funding Rules .

So the challenge is to look at the time line, define the elements, see who exactly Risk was managed for as Investor or to limit competition for big banks and other players when the Citizens were the priority stakeholders here in need of Jobs and Opportunities. And to the point of Risk how material could any class of crowd funding really be to the economy as in the aggregate there is built in diversification to the Asset Class unless crowd funding was all for the new widget in which case maybe crowd funding as a micro cap asset class could have hit stress test level risk but unlikely so do to the range of diverse founders and entrepreneurs passions and pursuits.

Anticipated Diagnosis:

We all failed if the answer is this ran an unduely long course. need to review to prove or disprove the assertions here and welcome the help of the community.

as looking to the issue below (see pictures and text in recap) also revisited renowned Educational Institution Villanova's new / new to me Frank Scarpa Center on Law and Crowd Funding since Villanova has strong accountancy and legal lines and anticipate economist lines too thought I'd throw them a pass to take a look at this with me on analysis through open contact will likely send the pass out to Harvard, MIT, Fordham, NYU, Columbia, Stanford and other knowledge driven points including PACE Law. Which raises a point of cross awareness to help the ALMA matter - quick plug for Pace.

Please read on below , my points are in draft here but I am working on many concurrent points and in this way I can share this quick and look for open teamwork on analysis.

Best Regards and see more below.

Dean

PS - in reality this a re look at this and I am glad I caught this now but wish I had caught on sooner as it seems like a big rub point that has been working against growth until recently... in the final analysis of any post we are looking to promote #ExceptionalTeamwork to help on #Jobs #Opportunities and #Growth that we all see as needed in the Economy and Financials.

Original Post inspiration via the SEC Forum on FINTech and reflections on a few points.... is it just a perception or a valid point that crowd funding / micro cap rules took forever a Rome Burned? and the need in reality in the Economy was Growth Capital and Not a prolongued over Study of Micro Cap Asset Class Risk to Crowd Funding beyond a simple investors ed line as such ala SEC 's Micro Cap Guide for Investors more on point SEC (IPA / Investor Protection Awareness) guide to Micro Cap Investing as Published 2/16/2016 .

http://dcarsoncpaprecision.blogspot.com/2016/11/sec-meeting-on-fintech-today-in-dc.html